Challenger Chronicles: Pink Chip–stock market bias meets its match

Unveiling the Disruptors—How Nimble Brands Redefine Industries

Let’s play a game. Imagine a world where only 7% of CEOs are women.

Spoiler: you’re already in it.

Now picture this—when a woman finally lands the top job, the stock drops 2–3%. Not because she underperforms, but because investors assume she will.

That’s not a glass ceiling. That’s a glass cliff.

But what if bias could become a buy signal? What if we could flip prejudice and make a profit?

Enter Pink Chip—a new index tracking female-led companies and the real cost of ignoring them. This is not another thinly-veiled brand stunt nor is it a moral reckoning. It is a market reckoning.

In Challenger Chronicles, I explore brands that are flipping the table. I am less interested in small tweaks. I like to profile brands that are rewriting the rules to challenge industry giants.

The Hook: Invest in Proof, Not Bias

Pink Chip is based on cold, hard data.

It’s the first live index that tracks top-performing, female-led companies in the U.S.—and it proves a simple truth: female CEOs outperform. But the market still punishes them for their gender.

That’s bias. And it’s costing investors billions.

Built by AKQA with Thematic, DEGIRO, and UN Women NL, Pink Chip is free on pinkchip.org and the DEGIRO app. No spin. Just numbers.

The Odds: Wall Street vs. Reality

Wall Street wasn’t built for women. 98% of assets are still managed by men.

That’s not just sexist—it’s bad investment. Closing the gender gap in leadership could boost global GDP per capita by 20%.

Pink Chip doesn’t call out bias—it cashes in on it.

The index speaks the only language the market respects: returns.

It’s a Trojan horse built on data, not guilt—and it’s getting through the gates.

The Differentiator: Data, Not Dogma

Pink Chip doesn’t do tokenism. It does results.

It’s criteria are simple, focused and highly defensible:

Female-identifying CEO

Listed on a major U.S. exchange

$2B+ market cap

8%+ annual revenue growth over 3 years

No pity picks. Just high-performing companies led by women—and the data to back it up.

Strategies and Actions: How Pink Chip Is Rewiring the Market

This is where you say, “but I’m not Pink Chip or a financial tool.” This series is about ideas behind brands.

Data, No Drama

Pink Chip lays it all bare—full methodology, full holdings. No smoke, no mirrors. Transparency in an ocean that is typically opaque. Just numbers speaking louder than noise.AI With Purpose

WPP Open and Thematic used AI and name-matching tech to sift through corporate filings, bringing female-led companies that had been hiding in plain sight to the surface. Note: AI only touched the backend—not the brand, not the message. That part? 100% human.Power Moves Only

With UN Women NL on the advisory board and DEGIRO (Europe’s largest investment platform) hosting the index for 2.5M+ users, this isn’t a fringe play—it’s a major-market move.Built to Scale

Pink Chip isn’t a campaign—it’s a legal entity. UK and EU indices are already in the works. This isn’t PR. It’s a platform for systemic change.

Breaking Through: The Impact

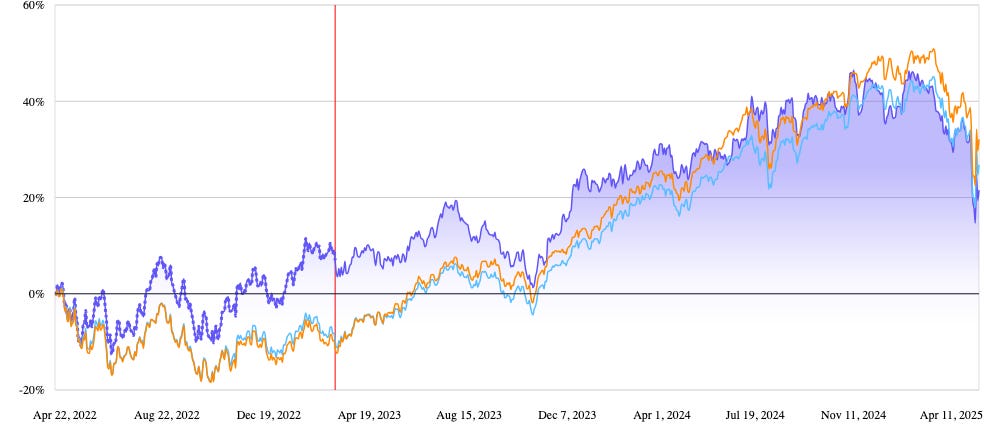

The numbers? Impressive.

70,000+ investors used the index in 3 weeks

14,500+ invested via DEGIRO (nice brand citizenship strategy!)

Pink Chip companies jumped 6.7% in stock price—adding $6.2B in market cap

The index itself surged 9.48%, outperforming both the S&P 500 and its male-led benchmark

Lessons for Other Challengers: Flip the Script–Reframe the Narrative

Pink Chip’s genius is in the reframing. It doesn’t ask investors to do the right thing. It doesn’t beg for fairness. It also doesn’t buy a Super Bowl ad to point you to an ephemeral brand stunt.

It proves the cost of bias. Bias costs us money.

It’s not about shaming. It is about showing.

Final Thoughts: The Future Is Pink (Chip)

Pink Chip isn’t just an index.

It’s a data-backed, AI-validated, market-tested sledgehammer to bias.

It’s proof that investing in women isn’t charity.

It’s smart money.